Tuesday, September 12, 2006

Step in to The Financial Matrix...

Sunday, September 10, 2006

Natural Resources and Portfolio Strategy

Commodities will defy cyclic pattern -- UBS

Ray Turchansky, Freelance

Published: Saturday, August 26, 2006

An interesting research report by UBS released out of Zurich this week hints that the traditional huge price swings in commodities such as oil may not take place during the next 25 years.

If so, that should make them core investments, rather than sector plays that people get into and out of during various parts of the market cycle. That would bode well for Canadian investors, offering some stability to equity markets laden with companies involved in energy and materials.

We've all heard the alarm bells that say we've already reached a peak in the production of oil, and that the world would run out of copper in four months if no more were found.

Instead, UBS Wealth Management Research says we will face a generation of strain on current sources of energy and materials before necessity becomes the mother of invention, when technology and education will bring about significant changes.

In other words, there won't be a rush to produce and therefore consume existing supplies overnight.

It admits that continued strong growth in demand for natural resources will keep supplies "thinly stretched in the near term," but predicts there will be "a peak in oil production within the next quarter century." Similarly, "under-investment in the search for base metal deposits will also limit any immediate expansion in production."

The rationale for thinking we won't run out of energy products and base metals quickly is that despite the rise in prices during the past few years, the prices are actually lower than during previous peaks when you adjust for inflation.

UBS, the world's largest wealth manager, feels that increased near-term demand for energy will be met by production of natural gas and other fuel substitutes, before long-term substitutes are developed that will reduce reliance on crude oil. Similarly, UBS says base metal reserves "are sufficient to meet long-term demand forecasts."

Certainly much of what is predicted is already happening.

Imperial Oil and Husky Energy have already announced delays to major oilsands projects. And Canadian Oil Sands has said that if it wins what has been a three-way battle to take over Canada Southern Petroleum, it would simply stash away the junior company's Arctic islands acreage for the future, because it may never tap into those prospective natural gas reserves.

The combination of a workforce stretched thin causing high labour costs and a sense that crude oil prices aren't about to collapse overnight has reduced much of the urgency to get oil out of the ground.

UBS paints a scenario of high infrastructure and investment costs delaying the development of substitute fuel sources, while geopolitical instability keeps oil supplies low for the next five years. In fact, it's tough to imagine there not being at least one Middle East oil supply at risk due to war at any given moment for the next 20 or 30 years.

Another factor you can throw in is global warming, which now produces an annual threat of a hurricane season that could disrupt supplies, thus renewing oil prices near their current levels on a regular basis.

As a result, UBS predicts oil production will peak in the mid- to late-2020s, and it will be overtaken by natural gas production by 2030, if not earlier.

As for base metals, mining will be hindered by underinvestment plus international trade and legislative restrictions concerning the environment. Therefore, there will be "no issue of depletion in the next 200 years or so for mineral commodities, like ferrous and non-ferrous metals."

Another major reason put forth by UBS for stable energy and base metal prices going forward is a change in where the demand will come from. The report says the gap in per capita income between people from developed and developing countries will shrink, and that "future growth in demand will likely flow from emerging markets."

The idea of energy and base metal companies being a rock upon which a portfolio should be built is a somewhat jarring notion. The S&P/TSX Composite Index is outperforming the Dow Jones Industrial Average and S&P 500 for the fourth time in the last five years. Could that pattern hold for the next five years, or the next 25?

Ray Turchansky is a freelance writer and income tax preparer. He may be contacted at turchan@telusplanet.net

© The Edmonton Journal 2006

Saturday, September 09, 2006

Divergences...

| Just done my weekly update of my "mythical portfolio" -- a basket of 10 junior mining stocks I've been following since 2001. My conclusion... stay Long and Strong! Over the last 5 weeks (since August 4th) a very unusual thing has happened. The POG has fallen 1.8%, but the PF has *gained* by 5.1%. This is *not* the normal behaviour. In fact with a POG drop of 2% say I would normally expect a PF drop of 4% or so. Instead the PF has gained 5%. i.e., We have a *strong* divergence, with the junior stocks leading the POG strongly. This tells me that we should expect a major move in both the POG and the junior mining stocks over the next 2 to 3 months. JMHO, and it would be nice if I was right! :^) | |

Thursday, September 07, 2006

Yikes

Wednesday, September 06, 2006

Having an IMPACT...

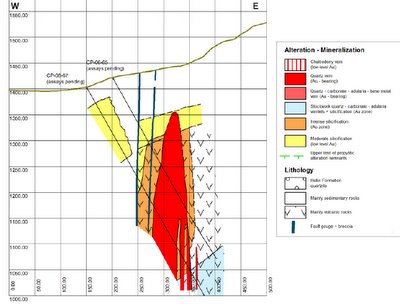

I mentioned recently that I liked the chart of IMPACT. I added to my position earlier this week and got the breakout today...

Crash Minerals?

Tuesday, September 05, 2006

Kirkland Lake Gold and the mother lode...

Kirkland Lake Gold Inc.: Drilling to the South Returns 5.57 Ounces of Gold per Ton over 50 Feet 'uncut'; Highest Grade Gold Intersection in New System and in Camp

Tuesday September 5, 6:56 pm ET

As part of this program, the Company is attempting to define the scale and size of this gold system through drilling and development mining out to the area via the 5300 Level cross cut. In Drill Hole 50-740 the Company has intersected high-grade gold mineralization on what is interpreted to be the north extension of the Lower D North Zone, one of the mineralized zones in this system. Drill Hole 50-740 has intersected 5.57 ounces of gold per ton (uncut) over a core length of 50 feet, including 181.5 ounces of gold per ton over a core length of 1.0 feet

This new 50 foot intersection correlates well with the two zones drifted on the Lower D North from the 5300 Level cross cut 360 feet to the west. The first of the two zones averaged 1.23 ounces of gold per ton (uncut) over a horizontal width of 7.3 feet and a drift length of 86 feet. The second averaged 2.12 ounces of gold per ton (uncut) over a horizontal width of 6.4 feet and a drift length of 67 feet (see press release dated August 10th, 2006).

"These results confirm the Company's decision to make generating information about this new area through stepped up drilling and development mining the operation's top priority," commented Stewart Carmichael, Chief Exploration Geologist. "In addition to this intersection in Drill Hole 50-740, there are six other mineralized intercepts further down the hole, grading as high as 1.11 ounces of gold per ton over a core length of 4.7 feet and 1.87 ounces of gold per ton over a core length of 1.1 feet."

Highlights of the current results include:

- Drill Hole 50-740 has intersected 5.57 ounces of gold per ton (uncut) over a core length of 50 feet, including 181.5 ounces of gold per ton (opt) over a core length of 1.0 feet. With all high assays cut to 3.50 opt, the interval averages 1.11 opt over a core length of 50 feet.

- The 181.5 opt assay over a core length of 1.0 Ffeet within the 50 foot intersection is the highest recorded drill hole intersection in the history of the Kirkland Lake Camp and replaces LK Zone discovery hole which held the previous record of 102.5 opt over 1.5 foot core length (see press release dated September 20, 2004).

Breakouts all over the place...

Orex!

I mentioned Orex Ventures back on 9/1 as having been in the Top Five for that day. Today, REX.V maintained it's rightful claim upon the throne with a stunning 38% gain. The stock is now overbought on the daily chart and is almost 30 cents over the 50 day EMA. With something like 25MM shares out, that's a value of $16MM or so. If they really have something substantial, that's a lot of upside potential, but it will be some time before they are able to drill Pamel.

Sunday, September 03, 2006

Uranium hits $52

From the site www.uranium.info:

In the Market ...

The spot uranium market was extremely active in August in spite of expectations for a “summer slowdown.” The highly anticipated results of the US Department of Energy (DOE) auction of 700 mtU as UF6 were released, indicating that the market remains hungry for supply. In addition, the auction of 100 thousand pounds U3O8 was met with aggressive competition from potential buyers. Sellers continue to seek market-related pricing terms for spot delivery. Buyers, in an effort to resist these market-related pricing terms, are accepting higher prices in order to obtain fixed pricing terms as evidenced by the results of this month’s two fixed-price auctions. The buyer mix remains diverse, with utilities, producers, and intermediaries seeking market purchases. Long-term uranium demand remains strong and continues to exert upward pressure on the spot uranium price. Historically, the spot uranium market becomes more active in September and TradeTech expects uranium prices to continue their upward climb through the month.

Fallen Appel and Docked Coxe

Tonight I read that Dr. Appel will no longer be publishing Financial Insights as he is starting a hedge fund focused on junior resource stocks and cannot divide his attention. Oh boy.

Saturday, September 02, 2006

Gold in GoldMoney...

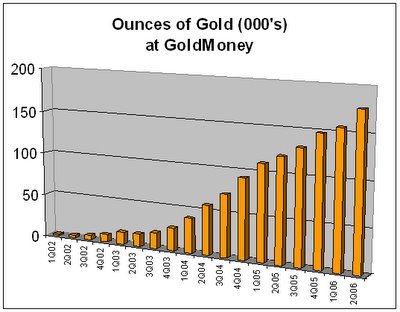

GoldMoney is one of the ways that you can own gold. The gold you purchase is allocated specifically to you, and is stored in vaults in London, insured by Lloyd's of London. Complete information about how it works can be found at the GoldMoney web site.

This chart shows the growth in the number of ounces of gold stored at GoldMoney, by quarter.

Friday, September 01, 2006

News for next week...

- Chesapeake Gold and American Gold announce definitive merger agreement

- Cash Minerals announces initial results from Lumina

- Aurelian Resources announces earth-shattering drill results

- Amarillo Gold announces drill results, property acquisition

- Pediment Exploration - projects update

Strathmore Minerals...

Bought Strathmore for the first time since 2004. Action seemed indeterminate this morning, so I bought 10K with a limit order that cleared the pipe. Only about 27K shares traded before I placed my order but over 400K traded by the end of the day.

Bought Strathmore for the first time since 2004. Action seemed indeterminate this morning, so I bought 10K with a limit order that cleared the pipe. Only about 27K shares traded before I placed my order but over 400K traded by the end of the day.Strathmore is a top-tier uranium junior with advanced projects that are in the permitting stage. Their property portfolio includes properties in New Mexico and the Athabasca Basin in Saskatchewan, Canada. They have excellent management with deep industry experience and plenty of cash in the bank.

The fundamentals continue to improve while the related stocks have taken haircuts of 40-60%. Now that the market appears to be turning, the technicals, seasonals (for resource stocks) and fundamentals are all nicely aligned. MACD looks excellent, as does RSI.

Note that every major rally has been characterized by a close over the 50. Next week will need to see follow-through, but the set up for the first week of September is about as good as it gets.

Harvest Season

Commander Res 20.00%

PolyMet Mining 17.18%

UC Resources 14.71%

Orex Ventures 13.16%

Buffalo

There is a strengthening consensus that September could be one for the record books for resouce investors. The merger announced yesterday between Goldcorp and Glamis is fueling speculation about further consolidation candidates and attracting attention to the sector. The market is closed Monday for Labor Day, but Tuesday should be interesting. Lots of news is pending on many fronts...